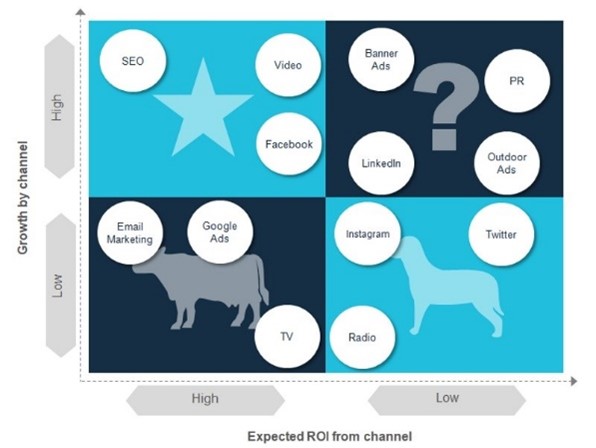

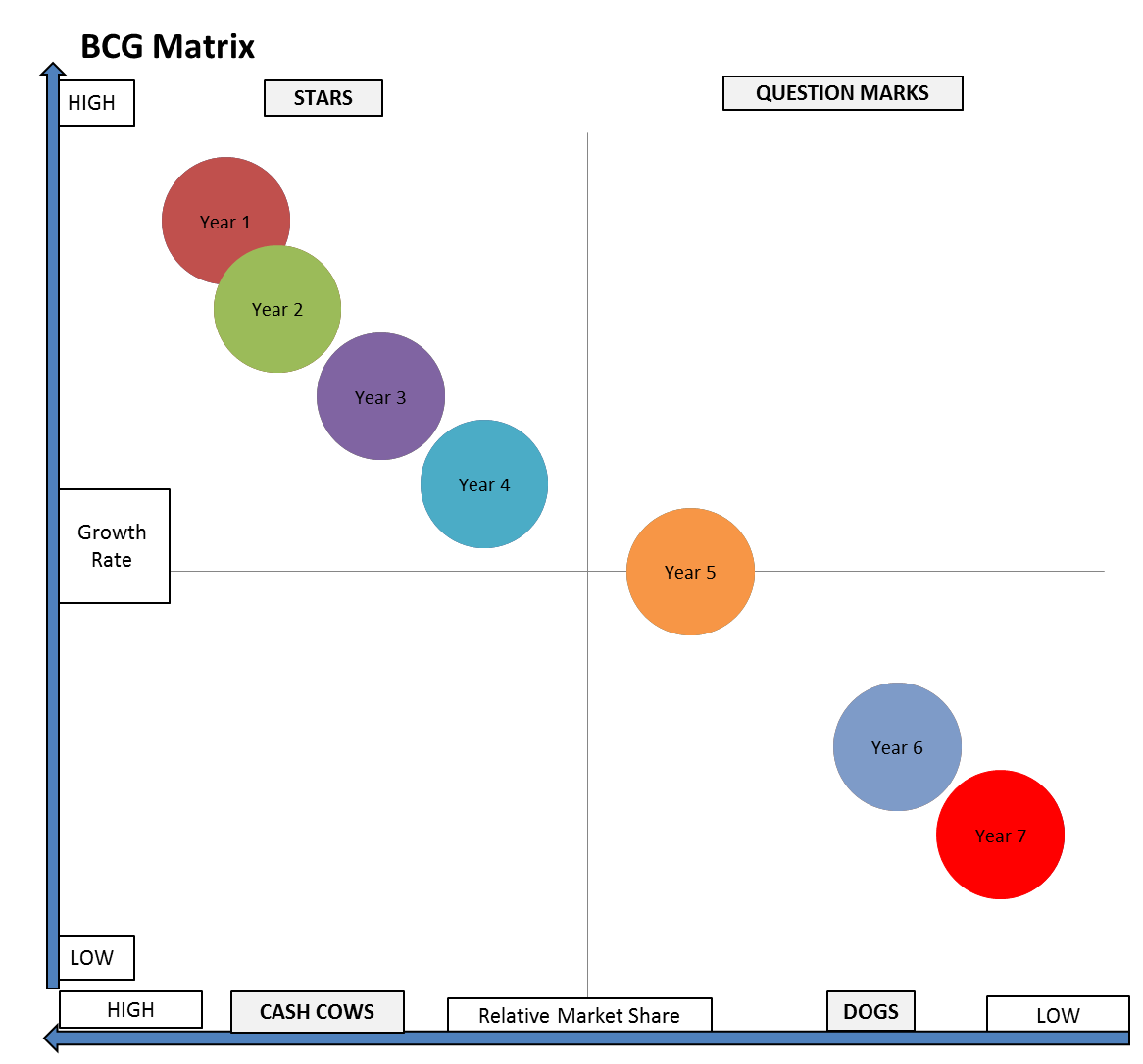

The dilemmas faced by the company include miscellaneous accessories, energy storage and solar power. This battery can be used domestic settings. The Powerwall also falls into this category. This is the case for all other vehicle models, which require little investment. The 3 series is the latest vehicle that has been released and has proven to be the most popular with consumers.įeatured - stars products represent a growing market.Ĭash cows are the products that continue to be profitable even in a low growth market. Tesla is indeed a leader in the sustainability industry, and all of its products and services are focused on a healthier environment. In the case of Tesla, the star products are the constant innovations in terms of electric vehicles as well as the production of cleaner energy. The star products or services, as well as the cash cows are considered leaders, while the other two boxes are more like followers. This matrix makes it possible to highlight each area of strategic activity of the company according to these two axes. The horizontal axis defines the relative market share, while the vertical axis corresponds to the market growth rate. Tesla's BCG matrix divides the group's activities into four categories. Tesla has secured more than 72,000 jobs, with an assured presence globally. In 2019, the brand delivered 367,500 cars worldwide. The group's revenues have also increased by 39%, compared to the previous year, as well as the liquidities that increased to $14.5 billion, giving the company additional strength. The company has recorded a net profit for the fifth consecutive year, and it was the world leader in the electric car market in 2020. Turnover currently stands at 31.5 billion dollars or approximately 26 billion euros. Quite the contrary, it has actually increased by 5.9% compared to 2019. Despite the health crisis, the group's turnover has not been impacted.

The company mainly manufactures electric vehicles. Tesla is an American company founded in 2003.

0 kommentar(er)

0 kommentar(er)